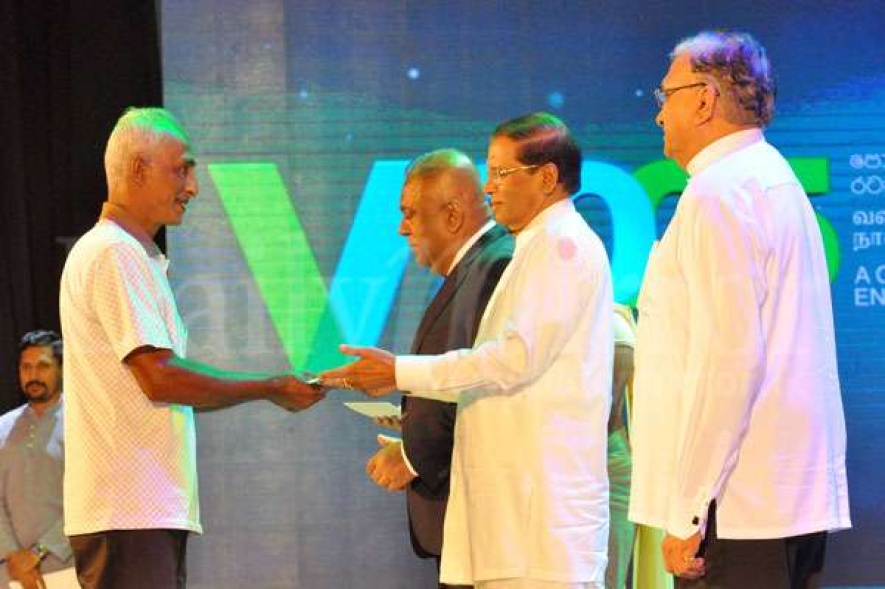

Delivering the keynote address at the launching of the ‘Entrepreneurs Paradise Loan Scheme – Enterprise Sri Lanka’ under the ‘Gamperaliya’ Rural Development Project at the BMICH last afternoon, President Sirisena went onto say that time was right to carry out a survey to determine the contribution that had been made by state owned commercial banks to expand and develop the rural economy and domestic industries.

“One may ask whether the huge profits collected by the state banks go to cover government expenditure or to the people. My opinion is that 50% of profits must be allocated as state revenue and normal banking services and the remaining 50% must set aside to facilitate the local industries. It is understandable if and when private commercial banks provide their services solely on profits. But a state bank has a national duty to perform by helping the local industry, increase exports and help generating employment because state banks have been established to achieve those noble objectives. We in many instances in the past have discussed about the huge profits make by state banks,” President Sirisena stressed.

President Sirisena said the assistance that must come from state banks to bring down unemployment, motivate local entrepreneurs, improve exports and develop the rural industry are being discussed widely in many a forum and among banks themselves, intellectuals and bankers. In those discussions, it has been revealed that there were about 100 loan schemes to help local entrepreneurs. It was also mentioned in those interactions that the knowledge among the people on banking services and products were low.

"That is why the Finance Ministry and Public Enterprise and Kandy City Development Ministry has launched this highly ambitious joint programme, ‘Entrepreneurs Paradise Lon Scheme – Enterprise Sri Lanka’. This programme has introduced 15 loan schemes selected from among 100 loan schemes,” President Sirisena stressed.a