President Wickremesinghe highlighted that the recently submitted Economic Transformation Bill is designed to achieve these ambitious goals within the framework of the constitution. He asserted that this legislation underscores his adherence to constitutional principles, thereby countering any accusations of unconstitutional actions.

The President made these remarks during his keynote address at the inaugural session of the 45th “SAARCFINANCE” Governors’ Meeting and Symposium held yesterday (13) at the Hilton Hotel, Colombo.

President Ranil Wickremesinghe noted that several countries in the region have recently held elections, resulting in the formation of new governments. He remarked that Sri Lanka is also approaching an election, which will be pivotal in determining the country’s future trajectory. The President emphasized the importance of this election, suggesting that it will decide whether Sri Lanka continues the cycle of changing governments every five years or sets a course for sustained national progress.

President Ranil Wickremesinghe highlighted the International Monetary Fund’s (IMF) positive assessment of Sri Lanka’s efforts to rebuild its economy. He noted that Sri Lanka has met all its quantitative targets for the end of December 2023 under the current economic program, with the exception of the indicative target on social spending. Furthermore, by the end of April 2024, the country had achieved many structural targets.

At a time when many doubted Sri Lanka’s ability to recover swiftly from its economic crisis, President Ranil Wickremesinghe expressed that the current situation has exceeded his expectations. He thanked all those who worked with him with confidence to achieve these results.

The conference themed “Central Banking amid Multi-Faceted Global Economic Challenges” will take place over two days.

Following is the full speech made by the President,

“The work we have been doing in the last two years, when many people didn’t expect Sri Lanka to come out of this crisis so quickly, has been remarkable,” President Wickremesinghe stated. He attributed this success to the dedicated efforts of the Central Bank of Sri Lanka, which played a crucial role in guiding the nation through challenging times by enforcing policies that curbed expenditure.

He also expressed gratitude to the Government and Reserve Bank of India, as well as the Government and Central Bank of Bangladesh, for their financial support, which he described as lifesaving. This assistance, along with aid from USAID and the World Bank, was pivotal in stabilizing the country’s economy.

President Wickremesinghe outlined future plans for Sri Lanka, including the introduction of the new Central Bank Act aimed at ensuring monetary stability. He also mentioned upcoming legislation such as the Public Debt Management Bill and the Public Finance Bill, which are expected to bolster financial and monetary stability in the country.

The President underscored the importance of combating corruption and detailed the government’s commitment to establishing a robust anti-corruption framework by 2025. He also highlighted the need for job creation and economic growth, stressing the importance of transforming Sri Lanka’s import-based economy into an export-driven one.

“Today morning, as the Governor mentioned, we had good news. Actually, it was better than what I anticipated. Because, reading briefly, we’ve been saying performance under the program has been strong. All quantitative targets for the end of December 2023 were met, except the indicative target on social spending. Most structural benchmarks due by the end of April 2024 were either met or implemented with delay.

The work we have been doing in the last two years, when many people didn’t expect Sri Lanka to come out of this crisis so quickly, has been remarkable. I was confident, and I am fortunate to have had a team that shared this confidence. I must acknowledge the role played by the Central Bank of Sri Lanka in guiding this group, especially under very difficult circumstances. They upheld policies requiring a curb on expenditure, something unfamiliar in Sri Lanka for a long time.

I must also extend my thanks to the members of the Secretary and the Ministry of Finance, who, along with the Central Bank, were responsible for formulating the policy and handling the pressures of budgetary restrictions that the Central Bank did not have to face. Additionally, I must thank the Government and the Reserve Bank of India and the Government and the Central Bank of Bangladesh. That three and a half billion and that 200 million were lifesavers. Without that, we wouldn’t be here today; there would have been chaos. Maybe this hotel would have burned down.

Their support allowed us to obtain some fertilizer, which we received as aid from USAID, and assistance from the World Bank. That was a tough year. I won’t delve into it here; it deserves a book, not merely one hour of discussion.

Today, you are meeting to discuss the issues of central banking amid multifaceted global economic challenges. This topic requires in-depth discussion for this region. I need not elaborate on the role monetary policy has played since the 2009 crisis and the measures needed to recover from COVID. You are also facing two issues: where the power lies in Montreal—is it exercised by the IMF with the present voting pattern? If not, what’s the challenge that can be posed by the BRICS? These are concerns for all of us, and South Asia should take a similar stand, especially with the move towards de-globalization after years of being urged to globalize. What happens to the international monetary system? But I will not go into detail on those.

I thought of speaking a few words about what Sri Lanka has achieved and what we plan to do in the coming years. To illustrate the depth of the crisis, let me provide a few facts. I was born in 1949. The fixed exchange rate at that time was 3 rupees 32 cents. In 1978, when I was in the Cabinet, we did away with the fixed exchange rate and moved to a floating exchange rate, which was 16 rupees per dollar. By 2009, we had reached 116 rupees to a dollar, despite expansive schemes like the Mahaweli Development Scheme, which required money printing. The IMF stated there was a moderate risk of external debt distress.

After 2009, when the war was over, the Mahaweli Scheme made us self-sufficient in rice, saving foreign exchange. Our free trade zones ensured our manufactured goods were exported, and we had a thriving tourist industry. By 2024, people expected the rate to reach 400 rupees per dollar. Today, it’s at 300 rupees. So, the story from 1949 to 2024 highlights that the growth of the economy often relied more on printing money than on central bank policies. As a borrower, we either borrowed money or printed it.

Fortunately, I was in a good position because my family was involved in printing, so I understood its limits. The new Central Bank Act, which we have presented, aims to ensure monetary stability. The central bank cannot grant credit to the government. There is no way to obtain loans from the central bank, nor can money be printed or taken from the state bank. This forces us to look at how to raise revenue. Additionally, there are inflation targets.

We have three laws: the Central Bank Act, the Public Debt Management Bill, and the Public Finance Bill, both of which will be passed by Parliament. These will form the framework of our financial and monetary stability. Once we carry this through, I see Sri Lanka achieving stability in monetary and fiscal affairs for the next decade or more.

The second issue is corruption. Corruption has been a significant issue in Sri Lanka, and everyone talks about how to address it.

No one tells us how to catch them. That’s the problem. So my government has come to an agreement and discussed the matter with the IMF. We also required their help, and we brought the governance diagnostic report. Many laws have to be passed. One has been passed, the Anti-Corruption Act. The second one, proceeds of crime legislation, is now being drafted to be sent to Parliament. There are a series of other laws that are required. By 2025, we will have the strongest anti-corruption system in South Asia and even, I think, in Southeast Asia, except for one or two countries. So this brings us to the next part of the issue. Now we have stability. The next issue is the one that worries all politicians: jobs. How do you create jobs?

There are a large number of people in our country who expect jobs. As the level of education goes up, they are not satisfied with just a menial job; they expect satisfactory jobs. In our country, virtually everyone has a mobile phone or two at most. But what is the expectation of a job? We have to realize that our per capita income also has to increase as we find jobs in this area. This is also a growth area. I was reading some reports, and I’d like to read from them. One of the World Bank reports on growth for 2024 states that growth in South Asia is expected at 6% for 2024. It’s one of the highest, but structural challenges hinder the ability to create jobs and respond to climate shocks. Are we going to get stuck with jobless growth, destabilizing the system? Or are we looking at growth?

This is what I thought we should address in Sri Lanka. We are all in this traditional British system where we don’t address the major policy changes required. We pass various enactments creating one authority or abolishing it and creating another one, but the total framework is not created by us. In many other countries, you find certain laws on economic development and regulating the financial system. We haven’t got that. We stick with the British policy of not doing it. Britain accepts a free market economy. We are in countries where it’s all debated: Do you want a free market economy, a socialist economy, a Marxist economy, a controlled economy, or socialism with Chinese characteristics or with Vietnamese characteristics? We just can’t make up our minds about what we want and what our goals are.

I thought we should bring in the third part of the legislation, which is the most important to me: How do we ensure economic growth? What do we do? For Sri Lanka to attain growth, we have to transform our import-based economy into an export-driven economy. As the IMF report says, “Nevertheless, the economy is still vulnerable, and the path to debt sustainability remains knife-edge. Sustaining the reform momentum and efforts to restructure debt are critical to putting the economy on a path toward lasting recovery and debt sustainability.” As a result, we have decided to bring a new law called the Economic Transformation Law.

We’ve had laws from the British rule onwards that created a colonial market economy dependent on plantations. In 1972, there was a breakup of capital formation and a strictly controlled economy. From post-1977, we started gradually liberalizing, but we did not bring the necessary legislation. A series of legislation brought in the 1972 economy, but we were chipping away after that. Each time we chipped away, there was some demonstration outside or a campaign against it. Nevertheless, we chipped away. I said, forget about that. Let’s put the new economy into place. We have failed; there’s no need to be shy about what you are doing. Do it and be done with it. That’s what Erhard did in Germany, what the Japanese did after the war, what the Chinese did, and what the Vietnamese did. There’s nothing to be frightened of.

I have not in any way departed from the principles of the democratic socialist system in our country. I have, in fact, incorporated two of the objectives: to ensure that all citizens have an adequate standard of living, and to create rapid development of the whole country by means of public and private economic activity towards social objectives and the public good. First, I put down in the law that I am working within this constitution. No one can say that I am going outside the objectives of the constitution. These two provisions are more than enough to rewrite the economic policy of Sri Lanka. It has to be growth-oriented; others have failed.

In clause 3, section 3, I put down that the national policy on economic transformation must provide for the restructuring of the debt owed by the government. The public debt to GDP ratio shall be below 95% by the year 2032. These are IMF targets. The central government annual gross financing needs to GDP ratio shall be below 13% by 2032. Now that is in the law. That is what we agreed with the IMF. The central government annual debt service in foreign currency to GDP shall be below 4.5% by 2027 and thereafter. This is one part of the national policy on economic transformation, which has some of the factors to be provided in the national economic transformation.

The second part is the transformation of Sri Lanka to a highly competitive export-oriented digital economy. This is a legal obligation, including diversification and deep structural changes in the national economy to boost competitiveness. The law states that we must have deep structural changes. I wonder if anyone can go to court and take action if we don’t have deep structural changes. Achieving net zero by the year 2050, increasing integration with the global economy, achieving stable macroeconomic balances and sustainable debt, modernizing agriculture to boost farmer productivity, incomes, and agriculture exports, and promoting inclusive economic growth and social progress are also part of the plan.

The cabinet of ministers, in formulating the national policy on economic transformation, must ensure the following targets: GDP growth to reach 5% annually by 2027 and above 5% thereafter. Unemployment should be below 5% of the labour force by 2025. Female labour force participation should reach not less than 40% by 2030 and not less than 50% by 2040. The current account deficit of the balance of payments shall not exceed 1% of GDP annually. Exports of goods and services as a percentage of GDP should reach not less than 25% by 2025, not less than 40% by 2030, and 60% by 2040. Net foreign direct investment as a percentage of GDP should reach not less than 5% by 2030 and not less than 40% after 2030. The primary balance in the government budget should reach 2.3% of GDP until 2032 and at least 2% from 2032. Government revenue should reach at least 15% of GDP beyond 2027. The multi-dimensional poverty headcount ratio should be less than 15% by 2027 and 10% by 2035.

These are difficult targets, but unless you make it difficult, you can’t succeed. If a government feels that it can’t achieve this, it must go to Parliament and get the act amended. Otherwise, you must act within this framework. This is opening up the system fully, and that’s what we are aiming for. It also means that, as I have done earlier, we all work together. I meet with the governor, my economic advisor, and others weekly. But it means that we can now put together a mechanism. A legal mechanism has to come into place, either by cabinet vision regulations or by law. We have the central bank, the treasury, and economic advisors all working together to achieve this objective.

Now, to begin with, I want to ensure that the initial beneficiaries of the measures we have taken with the IMF are the ordinary people of Sri Lanka. They are the ones who suffered most. They are the ones who lost their jobs, had to mortgage their properties, and sell their land. To ensure that, I have said that we should ensure the money goes to the bottom. Stabilizing the rupee and bringing interest rates down has been one benefit. With the help of the World Bank, we have increased social welfare payments threefold. From 1.8 million families, it will go up to 2.4 million families. That’s at the very bottom. We gave government workers a Rs. 10,000 allowance, and the private sector followed. The government ordered plantation companies, which had refused, to make a payment of Rs. 1,350 per day. It was a challenging course, and the court threw out the challenge. So we have ensured that money goes in.

We also created a district development budget. These are decentralized funds to build roads in villages or put up buildings, which means giving money to small contractors and others in the area. A fair amount has been given to the people. Since 1935, the government has been giving out land for people to cultivate, but never ownership, only through a permit. Similarly, we have built houses for low-income families in and around the city of Colombo, which are again given for rent. We took a policy decision, which we are implementing now, that all lands given to average people for building houses or for cultivating will now be given as freehold land. For those who have these low-income apartments, we will give title deeds, which means 2 million additional families are going to get this money. These are bankable assets, so look at how the banking service expands and how you take it to rural areas.

We are also bringing in new laws to change vocational training because large numbers go into vocational training more than university as they look for employment. These are some of the measures we are taking to ensure that the lower end of the population benefits from the measures we take. It cannot be confined to a few at the top. We want the big companies to expand, and I’m happy to see many of them expanding. We have already got hotels in the Maldives, and now we have investments in Bangladesh. We are seeing Indian investments coming into Sri Lanka. As we expand, I think we can deal with the economic issues relating to collaboration.

We are at a very significant moment. In many of the countries, we have just won elections, and new governments have come in. In Sri Lanka, we are going in for elections. Expectations are high. Is it going to be the usual way where we change the government every five years, or are we really going to deliver? The central banks have a major role to play in this.”

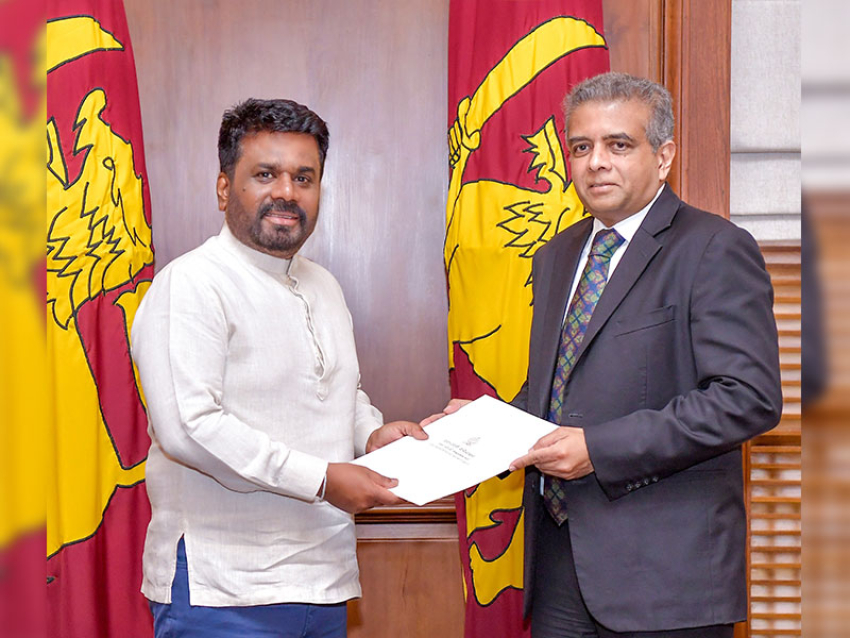

SAARC Secretary General Ambassodor. MD Golam Sarwar, Finance Ministry Secretary K. M. Mahinda Siriwardena, Governor of the Central Bank of Sri Lanka Dr. Nandalal Weerasinghe, Governor of the Reserve Bank of India Mr. Shaktikanta Das, Governor of the Royal Monetary Authority of Bhutan Mr. Dasho Penjore, Governor of the Maldives Monetary Authority Mr. Ali Hashim, Governor of the Rashtra Bank of Nepal Mr. Maha Prasad Adhikari, Governor of the State Bank of Pakistan Mr. Saleem Ullah, Central bank officials of SAARC countries and Treasury Secretaries of SAARC countries attended the event.