State Minister of Finance, Shehan Semasinghe said that an anticipated economic growth for the year 2024 is projected at 1.8%. The State Minister underscored the government’s paramount commitment to fostering a robust economy during this period. A particular emphasis will be placed on the advancement of small and medium enterprises as part of this overarching objective.

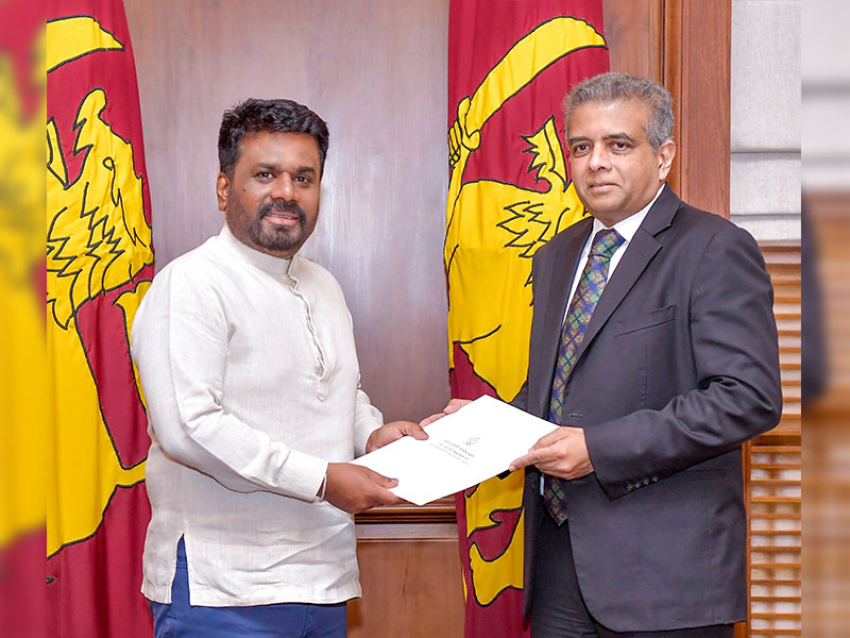

The State Minister further highlighted that the recently announced budget for the upcoming year places particular emphasis on addressing the needs of government employees, impoverished and economically vulnerable families. Additionally, a special focus has been directed towards the upliftment of small and medium enterprises. Minister of State for Finance, Mr. Shehan Semasinghe, communicated these priorities during his participation in yesterday (14) Press Briefing at the Presidential Media Centre (PMC), under the theme ‘Collective path to a stable country’.

State Minister of Finance, Mr. Shehan Semasinghe, also provided insights during the discussion, noting that the budget unveiled for the fiscal year 2023, following President Ranil Wickremesinghe’s appointment as the Minister of Finance, stands as one of the most formidable budgets in the nation’s history. Faced with the daunting backdrop of a severe economic recession prevailing up to 2022, the circumstances for presenting a budget in 2023 were notably challenging. Nevertheless, under the leadership of President Ranil Wickremesinghe, the government rose to the occasion and accepted this formidable challenge. Building upon the stability achieved, the Government is now successfully implementing the government program for the year 2024, propelling towards the envisioned economic objectives.

Had the government chosen to adopt a populist approach similar to the opposition during that period, the current state of the country might not have reached its present condition. Despite facing persistent accusations from the opposition, especially concerning the 2023 budget, the government remains resolute in its commitment to effective governance and fiscal responsibility.

Presently, the government’s focus lies on meeting the primary requisites of state revenue amounting to Rs. 4,127 billion, managing state expenditures totalling Rs. 6,978 billion, and addressing a budget deficit of Rs. 2,851 billion.

Aligned with the objectives outlined in this year’s budget, the government is diligently pursuing key targets as elucidated in the domestic debt optimization program. The 2024 budget is crafted with a strategic focus on alleviating the debt burden, aiming to reduce it from 128% to 95%. Concurrently, efforts are directed towards diminishing the financial requirement from 34.6% to 13% and curtailing foreign debt servicing from the current 9.4% to 4.5%.

In response to the prevailing economic challenges, the government’s approach involves providing essential stimulus to reinvigorate the economy. This involves targeted measures in areas that have garnered attention and commentary from various stakeholders over the past few months. The commitment lies in addressing the economic crisis by proactively responding to identified concerns and fostering sustainable economic recovery.

An integral focus to the priorities has been the domestic debt optimization, recognizing its pivotal role in achieving sustainable credit practices. The successful conclusion of the domestic debt optimization program has laid the groundwork for the on-going efforts in bilateral foreign debt restructuring. As we navigate this process, we hold the expectation that these strategic initiatives will pave the way for securing the second instalment from the International Monetary Fund (IMF).

In formulating this year’s budget, a particular emphasis was placed on addressing the needs of government employees, impoverished and economically vulnerable families, and small to medium-scale entrepreneurs. Despite the potential for engaging in populist measures, such as raising government employee salaries from January, the government pursued a correct course of action. The decision was made with the foresight and responsibility to prevent undue economic pressure on the country. These initiatives were executed under the direct guidance of the President, demonstrating a commitment to prudent economic management and sustainable policies.

In the current year’s budget, a dedicated focus was directed towards supporting small and medium enterprises (SMEs), which constitute over 50% of the country’s economy. A substantial allocation of Rs. 30 billion has been earmarked for their rehabilitation, divided into two segments. A facilitating institution, responsible for issuing guarantees, is set to be established in January under the Ministry of Finance. An estimated expenditure of Rs. 50 million is allocated for this purpose, alongside an additional Rs. 50 million designated for providing financial facilities at subsidized interest rates. It is the aspiration to further reduce this subsidized interest rate to a single-digit figure, reinforcing the commitment to bolstering the SME sector and fostering economic resilience.

Furthermore, this year’s budget, particular emphasis has been placed on pivotal initiatives, including granting land rights to the public, facilitating the acquisition of freehold deeds for ownership and implementing substantial educational reforms. These measures underscore the commitment to fostering economic strength and resilience in the year 2024. The overarching objective is to propel the nation towards robust economic growth, with a targeted rate of 1.8%. These strategic endeavours align with the vision to create a foundation for sustained economic prosperity and societal development.

The President has astutely identified and addressed the pressing issues faced by the public. Despite opposition to the budget, presented at a time of significant risk to life, it is noteworthy that the stability observed in the country today is a direct result of the last budget’s impact.

The absence of the unity observed among the members of parliament, who had recently come together for cricket, in addressing the economic needs of the country’s 22 million people is a matter of profound disappointment. This situation is indeed disheartening, and it raises questions about the priorities and collective responsibility of those in leadership roles. In light of these circumstances, there is a valid argument to be made that the leader of the opposition may lack the moral authority to question the budget.

The imperative to swiftly expand government revenue, particularly through the enhancement of the income tax collection network, is crucial for the economic stability of Sri Lanka. The program outlined by the President in this regard, if effectively implemented, holds the promise of averting a recurrence of economic crises. A robust and efficient revenue collection system is fundamental to sustaining fiscal health and fostering long-term economic resilience. The success of this initiative would contribute significantly to securing a stable economic trajectory for the nation.

PMD