The Sri Lanka Banks’ Association has emphasized that by optimizing domestic debt, the hard-earned funds of the working people in the country will be safeguarded from potential losses.

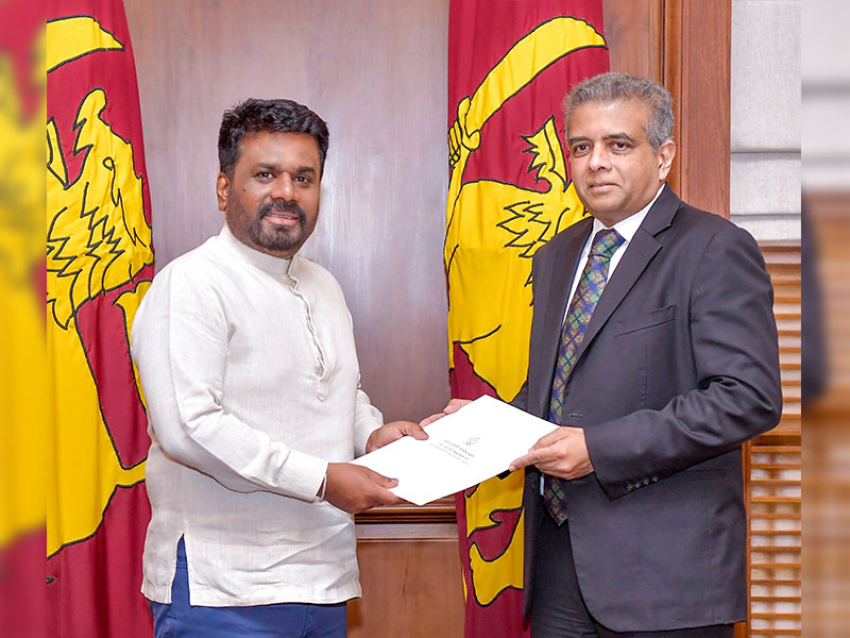

During an interview on the '101 Katha' program, Mr. Russel Fonseka, the Chief Executive Officer of the Bank of Ceylon and a member of the Sri Lanka Banks’ Association, expressed the importance of Domestic Debt Optimization. He highlighted the risk of funds, including the Employees' Provident Fund, being compromised if such optimization measures were not taken. This statement was made during his participation in the program produced by the Presidential Media Division.

Expressing his views further, Mr. Russel Fonseka said;

The need for domestic debt restructuring in Sri Lanka is not a recent development. As a nation, we have been grappling with a substantial gap between our import and export sectors for quite some time. With the exception of a few years after gaining independence, there has been a significant disparity between the money we spend on imports and the revenue generated from exports. To provide some context, in recent years, our annual imports have amounted to approximately twenty billion dollars, while our exports have only yielded twelve billion dollars. As a result, our successive governments resorted to borrowing to cover the deficit. However, due to the continuous cycle of borrowing and the burden of interest payments surpassing our trade balance each year, the country found itself plunged into a severe crisis. Furthermore, loans were also obtained for development activities.

As a nation, we borrowed more than our capacity could sustain. The consequences began to manifest by April 2022 when the Governor of the Central Bank had to declare that Sri Lanka was unable to meet its debt obligations. We simply did not possess the required amount of US dollars, and foreign countries were unwilling to provide us with further loans. Consequently, the credit crunch had a profound impact on our economy.

In the aftermath, the country's business owners and industrialists faced a challenging situation, with some even losing their jobs. This predicament eventually evolved into a social problem, leading to widespread protests and civil unrest. Ultimately, the government sought assistance from the International Monetary Fund (IMF) to alleviate the crisis.

To be clear, we lack the necessary income to repay our debts. Therefore, before we can begin the process of repaying the loans, we must establish a suitable arrangement. This is where the restructuring of domestic debt comes into play. As part of this process, a debt burden of 84 billion US dollars, encompassing both domestic and foreign loans, has been addressed. However, Sri Lanka's economic capacity was insufficient to repay this colossal sum of 84 billion dollars. The interest on these loans continued to accumulate each year, further exacerbating the economic crisis we faced.

Consequently, we had to devise a viable solution to tackle this 84 billion dollar debt burden. In restructuring our foreign loans, it is imperative to reach agreements with the countries that provided those loans, potentially leading to a partial write-off of the debt. During this debt write-off process, the significance of restructuring our domestic debt became evident. Foreign creditors express the need for restructuring not only their loans but also our domestic debt, emphasizing that they are willing to bear their own losses but expect us to bear comparable losses as well.

It brings me great satisfaction to see the government, the Ministry of Finance, and the International Monetary Fund supporting the restructuring of domestic debt in a manner that safeguards the interests of bank depositors in Sri Lanka. I want to assure everyone that the restructuring of domestic debt will not result in any loss or impact to the depositors. Additionally, the interest rates offered by banks will remain unaffected. Banks are committed to paying the applicable interest on fixed deposits for the entire duration. If fixed deposits were to be affected, we would undoubtedly witness widespread protests on the streets. However, such a situation is not permissible.

A significant number of bonds were issued to cover pension and provident funds, and the government has received the necessary funds while providing subsidized interest rates. I want to emphasize that there will be no reduction in treasury bonds. Instead, alternative solutions such as interest rate reductions and debt deferment are being employed. These measures ensure the security of employees' funds in EPF/ETF and other similar funds. Moreover, the government has guaranteed an interest rate of 12% for these funds until 2025, followed by a guaranteed interest rate of 9% until the maturity date. It is true that some may argue that the expected interest income might not be attained. However, the current trend indicates a significant decrease in market interest rates. We hope that the market interest rates align with the government-guaranteed rates for employee funds. Considering the decrease in inflation, the interest income provided by the government for employee funds is quite substantial. It is important to note that this interest income issue pertains only to contributory funds, and the reduced amount for other funds will be addressed by the relevant institutions.

Therefore, employees will not suffer any loss. It is indeed a positive outcome to receive substantial interest on the right amount of money through domestic credit optimization, rather than losing all the funds.

Once this economic crisis is resolved, the country will witness the creation of new job opportunities and a decrease in inflation. This program will bring numerous economic benefits to our nation. We will have easy access to essential goods and medicines, new businesses will emerge, and the gross domestic product will increase. Achieving this situation requires some sacrifices. Without them, we cannot prevent the country from falling into an economic crisis once again.

The banking association and local banks have agreed to support the President's program, which includes a planned reduction in bank interest rates. We can expect to see this rate cut within the next two months. Lower interest rates will enable small and medium-sized businesses, export-oriented enterprises, and major business ventures to flourish. Banks are fully prepared to provide the necessary support for this endeavour. I firmly believe that with the support of the Central Bank of Sri Lanka and the unity of banks, we will be able to overcome this financial crisis.

As bankers, we possess the ability to contribute to President Ranil Wickremesinghe's vision of nation-building. We hold significant power to make a difference. Moving forward, we will be able to offer loans to our customers at lower interest rates, supporting their various financial needs.