Minister Samaraweera said he would present the proposal to Cabinet this week, recommending capping annual interest rates at 30 percent for micro-finance loans, during a visit to Mullaitivu yesterday, to launch the Enterprise Sri Lanka programme at several banks in the Northern Province.

A cap on interest rates charged by micro-finance companies has been a long-term demand of groups agitating against exploitative loan schemes targeting the country’s poorest people. Activists say predatory loans charging exorbitant interest rates cause borrowers to take loans on top of loans, creating a cycle of debt that has impoverished communities that are already economically vulnerable, especially in the war-devastated regions, leading to suicide and other socio-economic tensions.

Enterprise Sri Lanka launched by the Ministry of Finance in June this year plans to grant subsidised loans to the public to encourage entrepreneurship.The lending scheme gives lower-income communities options beyond microfinance loans. The Minister presented cheques to a large number of loan receivers at several banks in both districts and the majority of the recipients were women. Prabajini Kamalraj, an expectant mother in Mullaitivu was obtaining a loan to complete the roof of her house before the arrival of her first child.

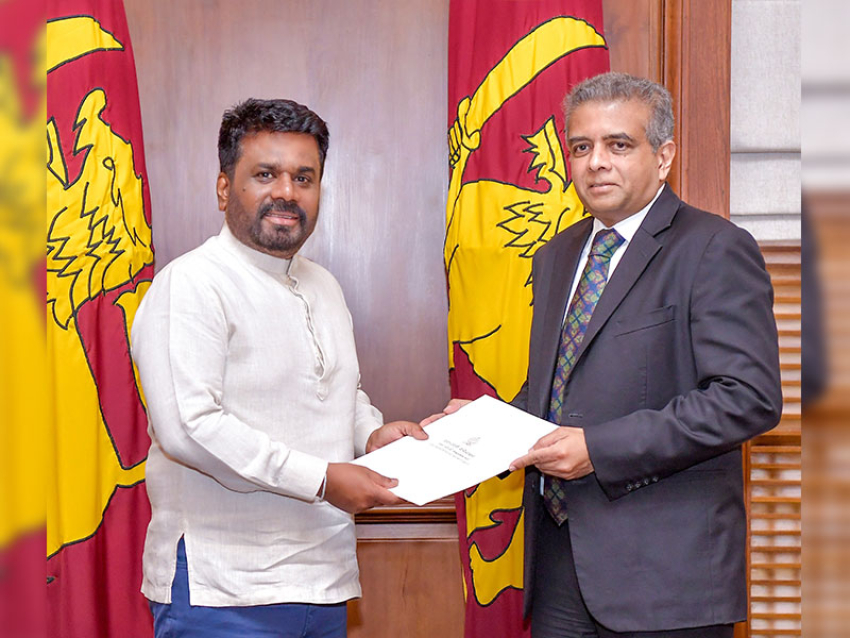

Invited by Minister Mangala Samaraweera to declare open the Enterprise Sri Lanka Desk at the Bank of Ceylon branch in Mullaitivu, Prabajini seemed pleasantly surprised. A majority of those obtaining the low interest loans hoped to build new homes or complete their partly constructed houses while others such as Pathmanathan Perumal, a peanut farmer, obtained a loan of Rs. 200,000 to buy a drizzling water system for his cultivation. Some also obtained loans to buy fishing gear, others to install solar panels for their homes and businesses. The borrowers acknowledged that the process was simple enough compared to obtaining regular loans from banks. However, some of those receiving the loans said they were already in debt.

Commenting on the Enterprise Sri Lanka program, political economist Dr. Ahilan Kadirgamar said it will most likely help to increase production in the North and support the growth of its economy. He said earlier loan disbursement by local banks was low in the North. “The banks have been reluctant to provide loans due to being in an economically bad situation,” he said.