“Sadly that doesn’t add up. If we want to continue with our free education and free health, we have to pay taxes. We have one of the most regressive and unfair tax systems in the world,” said Dr. Indrajit Coomaraswamy.

Hong Kong is one of the most attractive places in the world for businesses, with a low-tax environment that goes back to the 1960s. However, the country’s Gini coefficient score - a system used to compare inequalities is one of the highest in the world with the richest 1% controlling the wealth equivalent to 80% of the country’s Gross Domestic Product.

Making his remarks at the Cambridge Knowledge lecture organized by the Cambridge Alumni Society of Sri Lanka, Central Bank governor, Dr. Coomaraswamy pointed out that Sri Lanka collects 83% of its tax revenue from indirect taxes, where the richest person and the poorest person are treated the same way. “That cannot be right because the basic principle of any tax is fairness and the capacity to pay.

We have to move out from the indirect tax to direct tax ratio of 83:17 to about 60:40. “That means people have to pay more direct taxes to have a fairer system and the new Inland Revenue Act tries to move in that direction,” explained Dr. Coomaraswamy. Recently, Sri Lanka’s medical specialists threatened to withdraw from private practice if their requests for a revision to the tax structure were not heeded.

In response to their request, Sri Lanka’s Finance Minister Mangala Samaraweera said high-income professionals like doctors, lawyers, tuition masters and architects who are products of free education should pay their fair share of taxes. “It is only fair that they step up and start paying their taxes in line with the new law – then as a government we can look at giving more subsidies for the people,” the Minister said in response.According to the Inland Revenue Department (IRD), 69,000 new tax files have been opened in the past two months alone compared to the 400,000 total tax files that were opened in Sri Lanka to date.

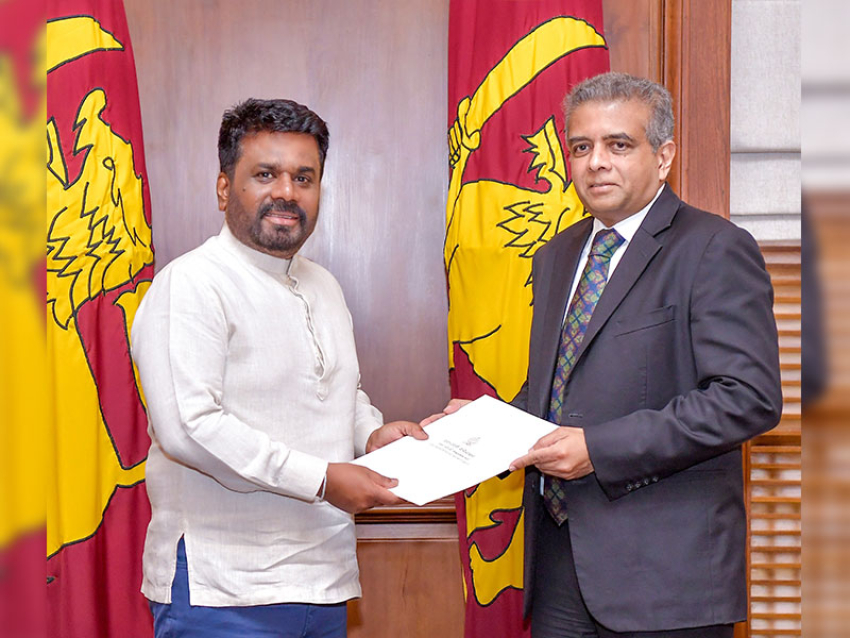

Commissioner General of IRD, Ivan Dissanayake recently disclosed that total taxes collected by IRD from January 1 to June 13 this year amounted to Rs.276.7 billion compared to the Rs. 256 billion collected in the corresponding period last year. “The government needs to be given a greater deal of credit for the ough reforms that it has undertaken in terms of revenue enhancement.

The increase in the VAT rate, removal of some exemptions, and introduction of the Inland Revenue Act that sought to simplify the tax structure and to widen the base were some of these measures,” Dr. Coomaraswamy highlighted.